Risk, Gambling, and Financialization

By George Kasabov

Contributing Writer

Since 1950, the US financial sector has grown almost three times in size. This growth has been accompanied by a switch of emphasis. It has increasingly turned away from the financing of industry and commerce and concentrated instead on the business of making money from money – the process of financialization. Banking, asset management, insurance and the owners of capital have found new ways to extract money without adding value to the rest of the economy. Finance has become more corrupt. But it is not just people in finance that have been “taking” not “making.” Top people in commerce and industry have learned to do it too.

One could say that this is not new, that ever since the birth of finance, over 5,000 years ago in Mesopotamia, those with money to spare have mostly been self-serving, bent on making a profit for themselves by usury, speculation, and rent. Also, the powerful have always aimed to control the government and legal systems for their own benefit, and since the beginning of modernity in the 16th century, merchants and financiers have increasingly gained that power.

Read More from This Article

How Money Merchants Came to Dominate Kings»

The Difference Between the Real Economy and a Perpetual-Debt Economy»

How Finance Has Changed Since the 1970s»

The Effect of Uncoupling of the Dollar from Gold, 1971»

Finance Plots to Regain its Power»

The Triumph of Financialization since 1970. Making More Money from Money.»

The Rise of Shareholder Value as a Prime Objective»

The Vast Increase of Pure Speculation – Many Times Greater Than Global GDP»

The Business of Finance Has Changed its Status»

The Deceit of Fictitious Wealth Creators»

Why Does This Perpetual-Debt System Require Constant Growth?»

Predatory Finance – The Parasite of Modern Times»

The Conflicting Aims of Financiers and of Traders in the Real Economy»

How Money Merchants Came to Dominate Kings

Early signs of this power transfer occurred in 1602, when the first modern Stock Exchange was set up in Amsterdam, shortly after the establishment of the Dutch East India Company (Verenigde Oostindische Compagnie, or VOC). Here merchants traded equities on a regular basis, as a secondary market to trade in VOC shares. Before then, the market had been limited to the sale of commodities.

The Stock Exchange was a new idea. It let merchants speculate (gamble) on the outcome of other merchants’ bets, which had been made on the risky business of trade with the Far East. More importantly, this new trade in financial instruments was not ruled by the established power of kings, but by the merchants themselves, by the VOC.

But an even more significant milestone in the financiers’ domination of government was the founding of the Bank of England in 1694. Here the king’s government needed money to pay for a war against France. City of London merchants proposed to found a private bank which would loan £1.2 million to the government for the war, at 8% interest. But there were two conditions for this loan: 1) the king’s government had to give this private bank the right to call itself the Bank of England, and 2) most importantly, this new bank would be allowed to issue banknotes as legal tender.

This privately owned Bank of England became the first longstanding central bank. It could issue almost unlimited amounts of money, as this money was backed by the tax that could be gathered from the whole Kingdom. Thus began the first National Debt, a debt to private individuals, without which our privately issued money would cease to exist.

It ultimately became the “lender of last resort,” supporting other commercial banks whenever they threatened to become insolvent. (By thus ensuring that commercial bankers would be bailed out, the central bank tempted them into more hazardous speculation, exposing them to what came to be called “moral hazard”).

The U.S. central bank, the Federal Reserve Bank, is also a private bank. It was specifically set up to be the “lender of last resort” by a group of top bankers meeting secretly on Jekyll island, Georgia, and set in law by an Act of Congress in 1913. It thereby centralized the power of U.S. banks into a privately owned entity that controls interest rate, money supply, credit creation, inflation, and (in roundabout ways) employment. It could also lend money to the government and earn interest, or a fee – money that the government could otherwise create free of charge. This ushered in the beginning of the modern U.S. National Debt, and henceforth the government relied more on borrowing from these private banks than on self-financing, as it had done prior to granting the power of money creation to the private commercial banking system.

As Bernard Lietaer et al write in Money and Sustainability: The Missing Link– A Report from the Club of Rome, “…money exists ‘not by nature but by law’. Thus, money is not something that comes out of …a mint …a printing press or a computer. Laws are created by those who exert sovereignty. How did the creation of money become predominantly privatized if it only exists by law? While the answer to this question and the timing are different in each country, they all share a similar sequence:

- In exchange for financing a war, a private bank receives the exclusive license to issue paper notes, thereby becoming a central bank.

- Government tax offices accept these paper notes for tax payments in addition to metallic money.

- The central bank becomes a source of credit.

- An emergency occurs – usually another war or major political crisis – and a shift of power takes place between the government and the bank.

- More paper money is issued than there are metallic reserves. To avoid a run on the bank, the convertibility to metallic money is legally abolished and the acceptance of the notes becomes compulsory.

- The paper currency becomes the only measure of value.”

More than 95% of our current money is fiat money privately issued by commercial banks as debt, and its historical evolution matches the pattern described above. This means that the power of financiers has grown inordinately since 1694. However, since the 1970s, this power has ballooned even more, and the changes that have occurred are unprecedented in both scale and significance.

The world is now in crisis, politically, economically and ecologically, and the way we conceive of money can be seen as largely responsible. For it is not on the same level of reality as human services, or physical goods.

We have been persuaded, falsely, to think of money as if it is a “real” commodity. The electronic blips of which it now consists should have made it obvious that it is not a merchandise which people can consume and trade, as if it is food or fuel. Nor is it a commodity that can be owned and used as a store of value, like iron ore or cloth. Money can only represent “real” goods and services. It can’t replace them.

At a time when its value could be measured in relation to the value assigned to gold or silver, it was easy to make this mistake. Indeed, the ancient Greeks had warned of this error with the legend of King Midas, whose touch turned everything to gold, even his food and his daughter. Now this error has become a major cause of our existential crisis.

The reality is that by using their immaterial debt-money as their merchandise, financiers make yet more money for those with money. So it becomes a “real” commodity because it is used as such, even though, paradoxically, it is not.

So, as long as financiers are in a position to levy interest on loans, they will continue to extract wealth from those who need to borrow, and money will continue to be a commodity, even if, in theory, it is not. The facts of usury make it so.

We can see who makes money with this insubstantial money by looking at the chart showing net interest transfers. Although it refers to Germany in 1982, it is characteristic of the relative size of interest transfers that occur in most developed economies between those with spare money to lend and those without. The German population is here divided into ten equal groups, from the poorest to the richest. Two of these groups receive interest, and eight of them pay interest. The two groups (the 20%, though mostly less than 10% of the population) who own most of the spare money have the power to make the rest (the 80%) comply with their demand to pay interest to them on their debts. Inequality has become even more extreme since then, as the 1% have risen up to the stratosphere of wealth (though before World War I inequality was even greater).

The Difference Between the Real Economy and a Perpetual-Debt Economy

Looking at the sea of corruption that has surrounded money, Money and Sustainability – The Missing Link asks:

“Over the past forty years, the world has been wracked by over 400 financial crises; they have destabilized economies, impoverished people around the world and wreaked havoc with the planet’s natural capital. Money and financial markets have become ends in themselves.

“… How could a simple invention which had, at its heart, such a laudable goal – to help people trade their commodities easily and effectively – go so wrong? Why have we this rift between finance and economy, between financial markets and the real economy they were meant to serve?”

To answer this, we must look at the distinction between, (a) the “real economy,” and (b) the modern “money economy.” These two have become increasingly blurred since the rise of banknotes, even before the founding of the Bank of England.

At one time, markets existed only to deal in real commodities. But the changes that took place in the 17th century mean that now we have financial markets as well (an extended version of the ancient money-changers).

But because we have had financial markets for well over three centuries, markets for money and its derivatives (the stock market and its offshoots), few people realize that the market for “real goods and service” is not actually dependent on the existence of financial markets. Only if we wish to use something now and pay for it in the future do we need to borrow.

In the market for “real” goods, debt and credit are intertwined. They depend on each other. A sale is a credit made on trust, with the expectation that it will be repaid – and that will be the end of it.

So the “real” market only needs money as a measure of value, and a means of payment; it circulates, greasing the wheels of commerce as it goes. It is of no practical use if it is used as a long-term store of value, hoarded, hidden away, put out of circulation.

But if there is a need for capital to start a new venture, to extend an existing one, or to pay for seeds before the harvest, then there is the need for borrowing – for debt. Here a lender has to assess the risk that his capital will be returned or not, and what profit the venture will make. For the benefits of trade and development are always accompanied by risk. So charging extra on a loan is an insurance against default. If possible, he will look for some kind of insurance beyond his own judgement.

The financial markets grew up as intermediaries between lenders and borrowers, to provide such insurance. Also, to gather capital and to avoid the dangers of risk and uncertainty. For nothing is certain about the future, and we have evolved as human animals to bet on what we expect the future will bring. We love to gamble. It fills us with anticipation and pleasure. Some even get addicted to it.

So financial markets are also casinos in which those with money to spare can gamble with money on the loss and gain of other money – regardless of the real economy. This process encouraged financial traders to treat the “money economy” as a part of the “real economy,” to forget that they reside on different levels of reality.

Financiers Aim to Create a Perpetual-Debt Economy, with Boundless Liquidity

However, unlike the market for real commodities which is based on payment when the deal is done, the modern market for money and its derivatives purposefully has no expectation of final repayment, no closure of accounts. There is only a need for money to remain permanently available, liquid. For the aim of financiers is to ensure that there is perpetual liquidity, so they can continue to make a profit from the interest and the fees which are their wages for dealing in bonds, shares, derivatives, and currency. All of which also lets them trade with their own money, aiming to make speculative gains.

Perpetual debt lets the financiers extract perpetual profit, and to pursue other policies, such as foreclosing on borrowers who can no longer pay. Foreclosures, which are in fact a form of legalized theft by financiers from the misguided poor – those who have been made greedy for commodities which they cannot really afford, but which they are tempted to purchase by going into debt.

How Finance Has Changed Since the 1970s

Although one could go back to the 18th century, when England’s money was preeminent, the latest phase of our story really begins after World War I, with the Roaring Twenties, when mushrooming money liquidity resulted in a tsunami of speculation.

The crash of 1929 put an end to speculation, and caused the Great Depression of the 1930s. The depression that was made worse by the “beggar thy neighbor” policies of many countries that foolishly continued with inflexible fiscal arrangements, and put up tariff barriers, thereby reducing trade, and forcing down prices and employment. This only began to change with the outbreak of World War II, when industrial production of armaments swelled, and generally spurred the U.S. economy.

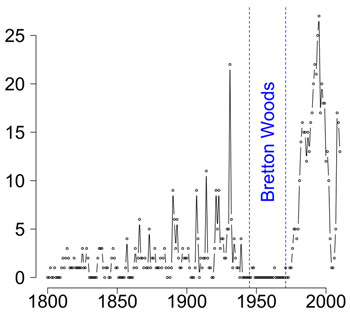

The depression of the 1930s had stimulated ideas about how to avoid a repetition of such a calamity, and, as the war was drawing to a close in 1944, a meeting was held by the allies in Bretton Woods, New Hampshire U.S.A. Its aim was to set up a new international financial system designed to avoid the “beggar thy neighbor” policies which had caused such havoc and suffering after the crash.

They agreed on a regulated system of fixed exchange rates between countries, and prescribed for a managed market economy, with tight controls on the values of currencies, which were initially only allowed to fluctuate within a range of ±1%.

Flows of speculative international finance were sharply curtailed by controlling them via central banks. This tight control meant that international flows of money only went into foreign direct investment (such as construction of factories abroad) while international bond markets and currency manipulation were forbidden.

This system needed an international currency for trade, investment and payments, and the British delegate, John Maynard Keynes, argued strongly for a supra-national reserve currency called the Bancor (“Banc” plus “or” which means gold in French), to be issued by an International Clearing Union (ICU). The proposed ICU was designed to ensure that debts were always cleared, so long-term imbalances could never build up between creditors and debtors. This was to be accompanied by a form of demurrage, the imposition of stiff charges on both debtors and creditors if they strayed too far out of balance.

As Ann Pettifor writes in The Production of Money: How to Break the Power of Bankers

“…at the heart of the ICU proposal would be the equivalent of a central bank: in this case, the master of all central banks.

“…this new international central bank, the ICU, would …manage flows of money between states, and …use a new currency, Bancor, as the relevant currency. (In other words, a neutral currency, not the currency of one imperial power.) Like any other central bank …the ICU would ‘clear’ deposits and withdrawals between trading states. And …provide an ‘overdraft’ to debtor countries, enabling them to continue trading. However, it would penalise countries moving into deficit by applying punitive interest rates on that country’s ‘overdraft’ with the ICU.

“But the proposed ICU differed from other central banks in one critical respect: it would also penalise countries that built up a surplus …countries that accumulated profits from trade, and deposited those profits in the ICU would be charged punitive rates of interest on the surplus.

“… this was necessary because imbalances – like those [now] between indebted Greece and profitable Germany – are dangerous. They lead to economic failure for the debtor and, with it, political hostility. Adjustment to restore balance between trading nations is therefore necessary if we are to prevent trade or currency wars, but also militarised war…

“…Keynes’s International Clearing Union would put an end to an…unjust system of international trade and finance; one that depends for financial gains on trade imbalances. … it would use market forces to create greater symmetry in the incentives for both debtors and creditors to end imbalances.”

Sadly, this very rare opportunity for the creation of a just and stable financial system across the world was lost. For the U.S. was determined to maintain its superior financial position. A position that had first come about 25 years before, when Britain and France were almost beggared by World War I. This disaster allowed Wall Street to rise to supremacy and to call the shots worldwide.

At Bretton Woods the Americans argued against Keynes’ International Clearing Union. They insisted that all currencies should be tied to the U.S. dollar, with a fixed exchange rate, and the dollar would itself be tied to gold at $35 an ounce. (At that time 90% of the world’s gold reserves were owned by America). Thus the U.S. dollar became the world’s reserve currency, used for almost all international transactions.

This system was still ultimately related to a fixed gold standard. It’s institutions, including the World Bank and the International Monetary Fund, maintained a balance of world trade and the world prospered from 1945 till 1971. This was a period during which there were no bank crises as reconstruction and development surged. The U.S. transferred $145 billion to rebuild Europe through the Marshall plan, and did it so that Europe could absorb more of American goods, keeping the U.S. economy buoyant. Everyone in the developed world, rich and poor alike, became richer. But although this was an attempt to restrain the destabilizing power of finance, it was too half-hearted to last.

By 1971, the Vietnam War and the Great Society programs had drained American reserves, and the U.S. dollar was in deficit in relation to U.S. holdings of gold. Its liabilities had risen to $70 billion, while it only had $12 billion in gold to back them up.

This made other countries afraid that their dollars might no longer be convertible into gold. At this point the British and the French both decided to ask for their gold from the U.S., as was their right under Bretton Woods rules. So, in August 1971, the French president, Georges Pompidou, ordered a destroyer to sail to New Jersey to redeem France’s holding of U.S. dollars for gold held at Fort Knox.

President Nixon was furious at this challenge to the hegemony of the American dollar, and on August 15, 1971 he unilaterally uncoupled the dollar from gold. Thus the Bretton Woods system unraveled. A dollar holding could no longer be converted into gold, and this made the US dollar into a pure fiat currency.

The Effect of Uncoupling of the Dollar from Gold, 1971

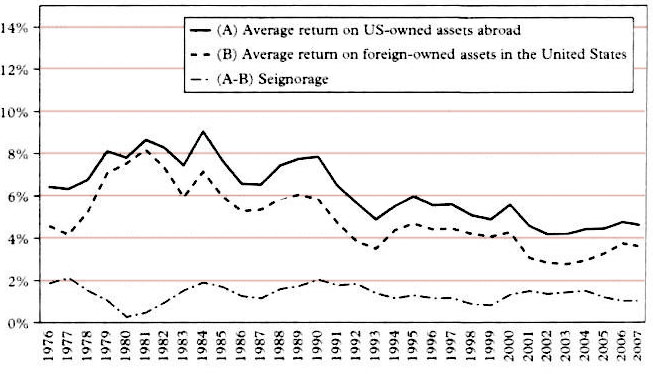

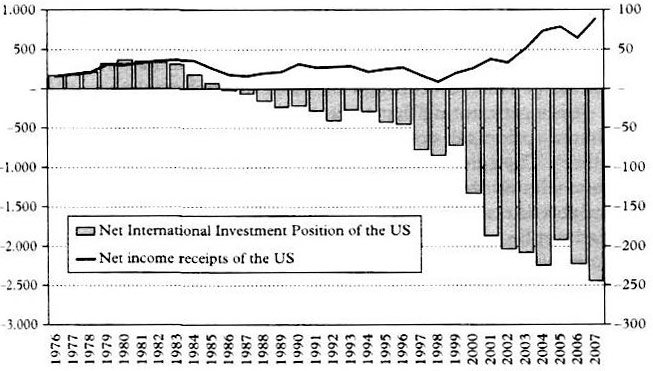

Nevertheless, billions of dollars remained in circulation outside the U.S., and from then on, dollar devaluation/inflation could not harm the issuer, the U.S., to the extent that it would reduce the wealth of all the other nations who used dollars for international trade. This has allowed the U.S. to dominate world trade, in a similar way that old style kings had done, when their monopoly of coin production gave them the power of seigniorage.

Being the country that produced an ever expanding reserve currency, the untethered dollar now allowed the U.S. to live with an ever greater trade deficit, while going further into debt. However, for all other countries, whose currencies were measured against the U.S. dollar, this was a disaster.

Between 1944 and 1971 no currency had been allowed to fluctuate more than ±2% against the dollar, but after the collapse of the Bretton Woods agreement, these restraints disappeared. The foreign exchange market exploded, and again allowed financiers to gamble without restraint on whether a country’s currency would rise or fall.

The power of concerted selling of any currency could depress its value, and force a country to adopt neoliberal policies, such as privatization of publicly owned services (like water, electricity and healthcare). This would enable financiers to buy the country’s public services for a song, providing a reliable stream of income for their new private owners – at the expense of its citizens.

Finance Plots to Regain Its Power

But even before 1971, people in finance chafed under the restrictions which the Bretton Woods system imposed on them, and began to work out ways to regain their pre-war power. It began with the Eurodollar market in the 1950s, when ways were found to circumvent restrictions on international financial flows by using dollars which were held outside the U.S. to provide liquidity. Liquidity which was used not for useful investment, but specifically to fund speculation.

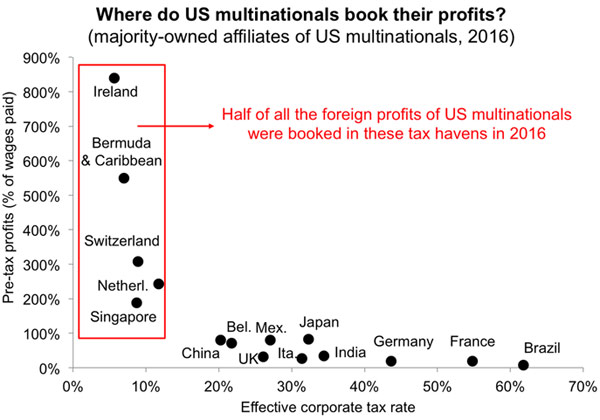

Another dodge was the use of tax havens to hide profits from their country of origin. The idea of tax havens had begun in the 18th century, with banking secrecy in Switzerland, which allowed foreigners to hide their often ill-gotten wealth there.

But by the 1960s tax havens really began to multiply. In America, individual states, like South Dakota, Nevada, and Delaware reduced their tax requirements to tempt companies to register there so that they could gain from their presence. Other tax havens were set up in British colonies, like the Virgin and Cayman islands, by movers from the City of London. These tax havens could grant extra-territorial status to individuals, companies and banks, so they could pay low, or no tax, and escape other regulations, such as anti-usury laws. (In French, tax havens go under the delightful name of Paradis Fiscaux, or fiscal paradises).

There also began a spate of deregulation. During the 1970s in America, longstanding state anti-usury laws were repealed or quashed. These had restricted interest rates to a ceiling of 8%. Now the result was that higher interest charges became common, prompting the issue of many more credit cards. Payment with cards had begun with the BankAmericard in 1958. As the practice became accepted by other banks, the name changed to Visa and was followed by other cards. The use of cards immediately caused an increase of personal debt and, ironically, a rise in GDP. The Supreme Court ruling of 1978 finally toppled all anti-usury laws in the U.S.

During the 1970s in America, longstanding state anti-usury laws were repealed or quashed. These had restricted interest rates to a ceiling of 8%.

Other deregulation followed, such as the Big Bang of 1987 and the repeal of the 1933 Glass/Steagall act in 1999. This act had separated investment banks, which gambled with money, from high street commercial banks, which dealt with the daily business of lending and clearing of accounts. This separation had been designed to prevent the repetition of one of the main reasons for the 1929 Wall Street crash – speculation using unsecured leverage.

The 1999 repeal of the act opened the doors to a surge of uncontrolled speculation. This was accompanied by the growth of the shadow banking sector, which had never been constrained by regulation, and had a flow of dealings much greater than even the traditional investment banks.

The 1999 repeal of the Glass/Steagall act opened the doors to a surge of uncontrolled speculation.

Meanwhile, the credit rating agencies, like Moody’s or Standard and Poor’s, which were meant to assess the creditworthiness, or riskiness of financial assets, were themselves corrupted by being allowed to profit from the very process they were meant to assess.

The Triumph of Financialization since 1970. Making More Money from Money.

Just like the pre-crash days of the 1920s, when mass consumerism first began, changes in the 1970s distorted the essential social function of financial activity, which is to facilitate commerce and industry by bringing debtors and creditors together. Instead, it focused on the self-enrichment of those who had money to invest (or gamble).

It became even more obvious that the primary objective of finance is not to benefit people and firms through loans to help cash-flow and capital investment, but to extract value by means of myriads of new financial instruments, or legalized scams, such as the Asset-Backed Securities (ABS), the Collateralized Debt Obligations (CDO), or the Payment Protection Insurance (PPI ). Most people were fooled into believing that such financial “products” were ways of making financial transactions free of risk – something that turned out to be a lie. For these so called “products” just became a means for the money men to make more money by moving money around, as if it was actual merchandise. In 2003, Warren Buffett even called derivatives “financial weapons of mass destruction,” and he was proved right, as they were largely responsible for the credit crunch of 2008.

It became even more obvious that the primary objective of finance is not to benefit people and firms through loans to help cash-flow and capital investment, but to extract value by means of myriads of new financial instruments.

The aim of all these was to enhance the market’s liquidity, making more of the bankers’ credit available to the system, thus enlarging the amount of money available from which they could make more profit.

The sharp practice of naked short selling became another way of making money just by trading in the financial market. Traders sell shares which they do not even own, just to drive down their price. They then buy them back for a lower price, thus making a profit at the actual owner’s expense. The actual owners may not even know what has happened and can finish up with a lower priced share.

Another well tried way of making money without creating anything in the real economy is the practice of asset stripping. This is achieved by banks when they create a boom (a bull market), during which they can over-lend cheaply, thus creating greater liquidity. Then, when the buying public can no longer afford the interest, the banks wait for a bust (a bear market) when speculators have over-extended themselves, at which point they can foreclose and buy the assets for pennies on the dollar.

An alternative form of asset stripping occurs when a speculator, such as a hedge fund, discovers that the assets of a business, its buildings, machinery, or brand, are worth more separately than together. The speculator can then buy the business cheaply and sell off its assets separately for more, making a profit for himself, but destroying the business in the process – leaving its employees jobless and customers abandoned.

A particularly vicious investment vehicle is the vulture fund which invests in distressed securities – debt considered to be very weak or in default. Investors in the fund buy the debt at a discounted price on a secondary market and then profit by using various methods to gain a larger amount than the purchase price.

The Rise of Shareholder Value as a Prime Objective

In commerce and industry, increased emphasis on shareholder value prompted financial advisers to work out new ways to increase the value of shares for shareholders and directors. They arranged for companies to buy back their shares, and thus to increase the price of each share by reducing the number of available shares.

This buy-back was particularly advantageous for senior executives, as they were in a position to pump up the value of their share-options sky high – simply by arranging for their company to borrow money to buy back their company’s shares. But this bonanza for shareholders drained funds from the actual businesses, making them less resilient, and more likely to fail. This twist also diminished the company’s value to all other stakeholders: the customers, the employees and the suppliers.

Stock buy-back was particularly advantageous for senior executives, as they were in a position to pump up the value of their share-options sky high.

It is striking that after almost 30 years, the chief evangelist of “shareholder value”, Jack Welch (legendary chairman of GE) turned round in 2009 and told the Financial Times that “shareholder value is the dumbest idea in the world…it is a result, not a strategy…your main constituencies are your employees, your customers and your products.” Ten years later, the New York Times reported that for the Business Roundtable, consisting of nearly 200 top CEO’s, “Shareholder Value is No Longer Everything…Instead, the group said, they must also invest in their employees, protect the environment and deal fairly and ethically with their suppliers.” Nevertheless, it remains to be seen whether shareholder value will actually be discarded, producing as it does short term gains for shareholders, including CEOs, regardless of the long term damage done to other lives.

So, since the 1970s such tricks have favored the wealthy and we have lived in a world of accelerating transfer of wealth from the many to the few, from the 99% to the 1%. During that time much of this wealth extraction has been redefined as wealth creation, and surreptitiously added to the throughput in the economy, to growth in the Gross Domestic Product (GDP), even though it has not increased actual wealth, but merely concentrated it in fewer hands. Since 1970, the rise in productivity has not enlarged the workers’ wage.

Note: Data are for average hourly compensation of production/nonsupervisory workers in the private sector and net productivity of the total economy. “Net productivity” is the growth of output of goods and services minus depreciation per hour worked.

Source: Economic Policy Institute analysis of data from the U.S. Bureau of Economic Analysis and Bureau of Labor Statistics.

The Vast Increase of Pure Speculation – Many Times Greater Than Global GDP

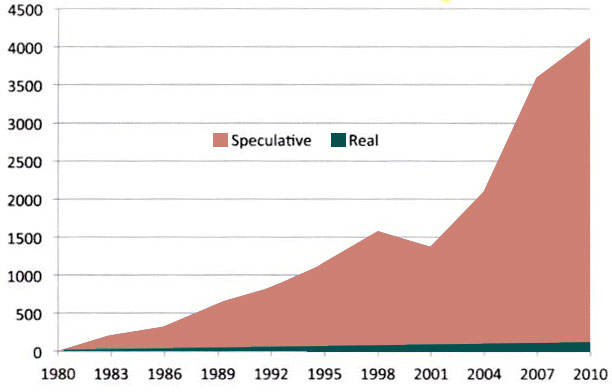

Bernard Lietaer writes, “Today’s foreign exchange and financial derivatives markets dwarf anything else on our planet. In 2010, the volume of foreign exchange transactions reached $4 trillion per day. One day’s exports or imports of all goods and services in the world amount to about 2% of that figure. Which means that 98% of transactions on these markets are purely speculative. This foreign exchange figure does not include derivatives, whose notional volume was $600 trillion – or eight times the entire world’s annual GDP in 2010.

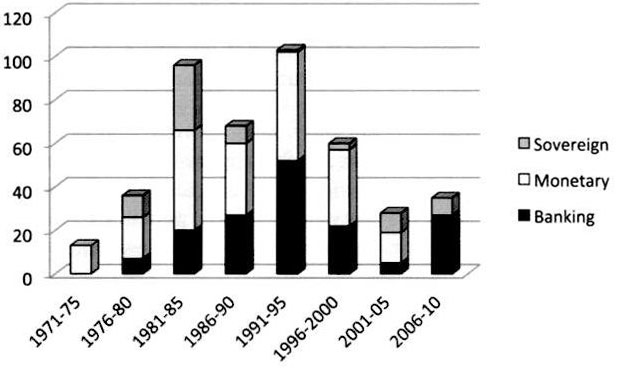

“…it was in this colossal market that the 2007 banking crisis broke out. As with every previous banking crash, governments felt they had no choice but to rescue the banking system, at whatever cost to the taxpayer. While this is clearly the biggest crisis we have experienced since the 1930s, it is not the first one. According to IMF data… between 1970 and 2010 … [there were a] total of 425 systemic crises, i.e. an average of more than ten countries in crisis every year!”

The Business of Finance Has Changed its Status

The financial sector has changed its designation. From a “service” it has become an “industry.” No longer a service which facilitates business by responsible due diligence in the provision of loans, business advice, and money transfer, it now calls itself an industry which produces so-called “financial products,” as if they are useful gadgets. Whereas they are, in fact, gambling games to play in the casino of perpetual debt.

In How to Speak Money, John Lanchester calls this intentionally misleading verbal inversion, “reversification,” the back-to-front language with which the financial sector keeps outsiders in the dark about just what it does.

- Extraction of wealth becomes wealth “Creation.”

- Speculation (actually, gambling) becomes “Investment.”

- A risky financial instrument, like a CDO, becomes a “Security.”

- Debt becomes “Credit.”

Thus the names of all these extractive activities are switched away from a negative to a positive connotation. Euphemism reigns supreme. (Just as, in the sphere of government, the department of “war” has turned into the department of “defence”). It makes the distasteful, tasteful, uncertainty, certain, and we are lulled into a state of inattention.

We are no longer encouraged to save for what we want. Instead we have been persuaded to assume that it is good and proper to go into debt – paying with unpredictable future wealth (plus interest and fees) – for what we consume in the present. This mental change has taken decades of public re-education by the financial sector, so that, even at a time of stagnation, it enables the financial sector to extract a greater proportion of wealth from the rest us – simply by fostering debt and usury.

We have been persuaded to assume that it is good and proper to go into debt.

We have Credit Cards, named so we don’t recognise that these cards are intended to put us into debt. In fact they should be known as Debt Cards. Debt Cards by which the banks demand payment of usurious rates of interest. For instance, in 2019 the Amazon Classic Master Card has a representative APR (variable) of 29.9% APR, a rate at which debt doubles in only 2.5 years.

We have to recognise that, since the 1920s, particularly since 1950, we have all become inextricably enmeshed in an economy based on debt and gambling. More people speculate on the stock market, more buy “financial products”, and more rely on pension funds which play the stock market with our savings and are the largest category of investor.

Now stock market news no longer just appears in the financial pages of the papers, but on our mobile phones too – helping us to gamble. Moreover, financiers have persuaded governments to apply lower tax rates on capital gains from these gambles, made by those with money to spare, than the tax rates on wages for actual work.

The Deceit of Fictitious Wealth Creators

As Mariana Mazzucato writes in The Value of Everything: Making and Taking in the Global Economy, “We often hear …entrepreneurs …talking about themselves as ‘wealth-creating’. The contexts may differ – finance, big pharma or small start-ups – but the self-descriptions are similar: I am a particularly productive member of the economy, my activities create wealth, I take big ‘risks’, and so I deserve a higher income than people who simply benefit from the spillovers of this activity.

Regulations, which had been put in place as a result of previous bad experience, were revoked, and this opened the doors to scams galore, most of which paid the financiers very well.

“But what if … these descriptions are …just stories? …created in order to justify inequalities of wealth and income, massively rewarding the few who are able to convince governments and society that they deserve high rewards, while the rest of us make do with the leftovers.

“In 2009 Lloyd Blankfein, CEO of Goldman Sachs, claimed that ‘The people of Goldman Sachs are among the most productive in the world.’ Yet, just the year before, Goldman had been a major contributor to the worst financial and economic crisis since the 1930s. US taxpayers had to stump up $125 billion to bail it out.”

So how has this happened? The immediate reason is that the financial sector lobbied for, and received, many instances of deregulation. Regulations, which had been put in place as a result of previous bad experience, were revoked, and this opened the doors to scams galore, most of which paid the financiers very well.

After the crunch of 2008, the Wall Street Journal reported that banking business is even better than ever: the bonuses paid out for 2010 by the twenty-five largest Wall Street institutions amounted to $135.5 billion, surpassing even the all-time record of 2007.

Why Does This Perpetual-Debt System Require Constant Growth?

Finance is essentially a system that enables us to take value from the future and put it into the present. How do we pay for this transfer? We pay interest. Since 5,000 years ago, when this process was invented, it has enabled those with a surplus to charge interest for lending their surplus to the needy. This interest charge extracts an “extra portion” from the future – value not earned by productive activity, but resulting from the exercise of skill and power, or just from the luck of birth.

The question that needs to be answered is: if the “extra portion” is not created by increased productivity, where does it come from? The answer to that is: this “extra portion” has to be extracted from our habitat, our environment, from the finite sphere which is our world.

In the traditions of the three Abrahamic religions and others, there is a long history in which the charging of interest, called usury, was unacceptable. To charge members of your clan, tribe, or religious community for financial help was recognized as a practice that destabilized the community as a whole. For not only were the borrowers put under a severe disadvantage by the lenders, but also, if they could not pay the interest, they would fall outside the economic circle of the community – they could not keep the wheel of commerce turning.

If the interest charge is 5%/annum, then the economy has to be 5%/annum larger.

Now, the business of finance has always been to make money by lending money. It profits by charging interest and fees on loans. But by demanding this extra charge, over and above repaying the sum borrowed, the future economy has to be proportionately larger than the present one. It has to grow.

If the interest charge is 5%/annum, then the economy has to be 5%/annum larger. It has to grow enough to pay this charge every year – compounded, exponential growth. $1 lent at 5% doubles to a debt of $2 in 14 years. Doing so is taking from the future without paying – a form of theft from our children and our common inheritance.

Before 1500 CE, when the world population remained more or less stable at only 0.5 billion, the impact of such a demand for growth was negligible. But with the explosive growth of population since then, reaching the current 7.5 billion (15 times larger), the impact on the environment of such compound growth has become massively unsustainable.

Even though much of the growth has been in increased productivity per worker (doing more with less), growth due to moneylending with interest is essentially a parasitical activity, not adding any value, but feeding off the natural environment.

Growth due to moneylending with interest is essentially a parasitical activity, not adding any value, but feeding off the natural environment.

Indeed, until the 1970s, economists and statisticians considered banking and other forms of money-lending to be un-productive. A necessary service perhaps, but not one that added to the economy. Since then, bankers have persuaded the statisticians, and the rest of us to accept that they are not economic parasites, but actual “wealth creators” – all part of the “reversification” which John Lanchester writes about in How to Speak Money.

Politicians, mainstream economists, and the media continue to measure societal success by growth of GDP. A very dubious way to measure success, as it only measures an increase in the throughput in the economy, not the welfare of society. Growth of throughput is obviously unsustainable. The question is, how to stop it.

The Trap of the Perpetual-Debt Economy and The Bankers’ Money

In their drive to gain ever more profit, financiers have now persuaded most of us to take on ever more debt. No longer do we save for what we want, but we expect that we can buy everything with borrowed money – debt, on which we have to pay a vast heap of interest; interest that enriches only the rich. One result has been that now there are many thousands of attempted suicides per annum in the UK alone that can be attributed to the pressure of debt collectors hounding those who can’t repay.

We have become so accustomed to living with debt, to usury, that it is inconceivable to most people that there should be any other way to pay for things. This view has been cultivated carefully by commercial banks, which profit from their issuance of debt.

In our ignorance, we can’t imagine that there could be public money which is interest-free, not backed by a national debt owed to financiers. But it has existed before, with the Greenback dollars issued by Abraham Lincoln in the civil war, and it does exist now, with all the complementary currencies around the world, like the WIR franks in Switzerland, or the Bristol Pound in the UK.

However, if we continue to use only the money that commercial bankers create and for which they make us pay, we will remain in bondage to their overwhelming power. Their system will also be subject to regular collapse, until it finally consumes the very habitat we live within.

Predatory Finance – The Parasite of Modern Times

Every decision about the future involves risk and uncertainty. Every living creature gambles that what it expects to happen, will actually happen. We try to make the best bets that we can, to save us from surprise.

Like a parasite, the casino of finance eats its host from the inside, and looks set to kill the very civilization that created it.

Our modern civilization has grown and prospered more than those before not only by gaining deeper knowledge of the universe, but also by founding institutions that thrive on this essential act of gambling on future outcomes. It turned such gambles into an official way of life when it created the casino of finance; when it enshrined in law the form of private debt-money that commercial banks create, together with the stock exchanges and the information systems serving them. This casino has helped some people take much money from the rest. By concentrating wealth, it has promoted developments that otherwise would probably have not occurred.

But in so doing, we have all paid a heavy price. For the casino’s only business is to remain in business; to make a profit for its masters. Not to keep alive the culture that created it. Like a parasite, it eats its host from the inside, and looks set to kill the very civilization that created it.

Our task – the task of politicians, philosophers and scientists, is to control this parasite, to claim the power that it has usurped. This will demand clear thinking, great imagination, and great fortitude.

The Conflicting Aims of Financiers and of Traders in the Real Economy

In our current economic system, the aims of financiers and traders in the real economy are always in a state of conflict and also of mutual dependency. A story titled “Moment in Time”, from Idries Shah’s The Exploits of the Incomparable Mulla Nasrudin provides a pattern for how to think about such an apparent paradox:

“What is Fate?” Nasrudin was asked by a scholar.

“An endless succession of intertwined events, each influencing the other.”

“That is hardly a satisfactory answer. I believe in cause and effect.”

“Very well,” said the Mulla. “Look at that.” He pointed to a procession passing in the street.

“That man is being taken to be hanged. Is that because someone gave him a silver piece and enabled him to buy the knife with which he committed the murder, or because someone saw him do it; or because nobody stopped him?”

This paradoxical dependency, this perpetual-debt economy, has appeared in part by chance; by the particular complex of historical events that came about well over 300 years ago. It is not an inevitable, nor permanent condition. An opportunity to change the story, to nudge it onto a different course, occurs only on some occasions.

When another opportunity occurs, it could, and might be changed. How, when and by whom, will be another story. Meanwhile, there are people all over the world working on alternatives.

Capital in the Twenty First Century

Thomas Piketty

A leading economist documents the trend of income inequality through history, stressing that the way an economy functions is directly related to a power structure that is determined and maintained by the few who hold the wealth.

Doughnut Economics

7 Ways to Think Like a 21st Century Economist

Kate Raworth; reviewed by George Kasabov

A “renegade economist” advances a new, more comprehensive and regenerative economic model – one based on a view of humans as socially adaptable beings in a world of limited natural resources. A view that factors in the love and caring of family life, the kindness and cooperation of society, and the search for meaning and morality over the getting and spending of money as the essential aim of human existence.

The Business of Changing the World

How Billionaires, Tech Disrupters, and Social Entrepreneurs Are Transforming the Global Aid Industry

Raj Kumar

In 2000, Raj Kumar and friends created Devex, an online community for global development that matches up organizations with funding opportunities and provides the largest database of grants, tenders, and other funding information. This book was written 20 years later to provide a clearer picture of how the aid industry operates, and where it’s headed.

Creating a Learning Society

A New Approach to Growth, Development, and Social Progress

Joseph E. Stiglitz

A Nobel economist and a leading finance expert posit the view that learning is more important to growth and development than the accumulation of capital. The traditional view of an inherently efficient free market, and of government regulation as the major source of economic difficulty, impedes the raising of a society’s standard of living by discouraging the production and dissemination of knowledge.

In the series: The Changing World Economy

- Debt, Trust and the Functions of Money

- Power, Money and Stability

- Substitute Moneys and Cryptocurrencies

- Risk, Gambling, and Financialization

- Forgiveness of Debt and the Creation of Money

- Capital in the Twenty First Century

- Doughnut Economics

- Global Poverty Today

- Multilateral and Bilateral Aid

- The World of the Poor

- The Business of Changing the World

- Creating a Learning Society

Further Reading

External Stories and Videos

Three Investment Banks Control More Wealth Than GDP of China – and Threaten Our Existence

Paul Jay, theAnalysis.news

Money managers have enormous power as they invest trillions of dollars across a spectrum of companies and vote those shares on behalf of their clients. Managers vote on management changes, board elections, mergers and acquisitions, special shareholder proposals and thus wield great influence on the CEOs of these companies.

Watch: Money and Sustainability: The Missing Link

Global Community Initiatives

Bernard Lietaer prepared a report for the Club of Rome on the link between our monetary system and the unsustainable trends in the world – this is a summary of the report.

Watch: The Value of Everything | Mariana Mazzucato

Founders Pledge

Who are the makers and takers in our economy? If we want sustainable and fair economic growth, Professor Mazzucato argues, we need to question the stories we’ve been told about value creation.